What Is Ordinary Interest?

Ordinary interest is a method of calculating interest on a loan or investment based on a standard 360-day year instead of the actual 365 or 366 days in a calendar year. This simplified approach is commonly used in banking and finance for ease of computation.

Formula for Calculating Ordinary Interest

The formula for ordinary-interest is straightforward:

Ordinary Interest=Principal×Rate×Time (in days)360\text{Ordinary Interest} = \text{Principal} \times \text{Rate} \times \frac{\text{Time (in days)}}{360}

Key Terms:

- Principal: The initial amount of the loan or investment.

- Rate: The annual interest rate (expressed as a decimal).

- Time (in days): The duration of the loan or investment.

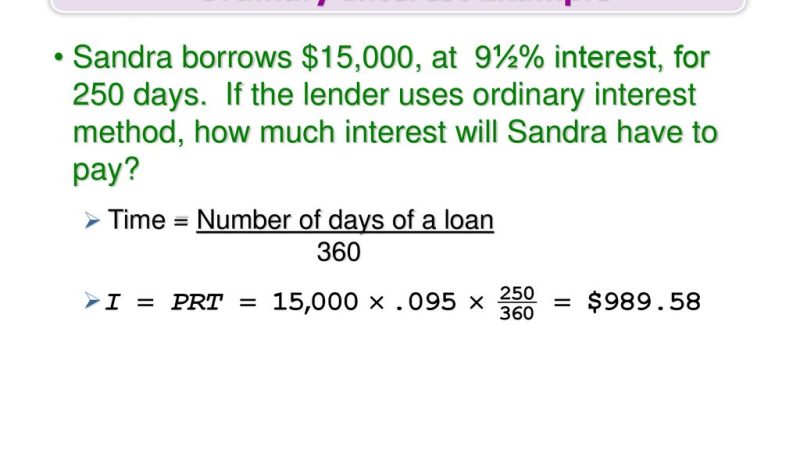

Example of Ordinary Interest Calculation

Suppose you borrow £10,000 at an annual interest rate of 5% for 90 days.

- Principal (P): £10,000

- Rate (R): 5% or 0.05

- Time (T): 90 days

Ordinary Interest=10,000×0.05×90360\text{Ordinary Interest} = 10,000 \times 0.05 \times \frac{90}{360} Ordinary Interest=10,000×0.05×0.25=£125\text{Ordinary Interest} = 10,000 \times 0.05 \times 0.25 = £125

The ordinary-interest for the loan is £125.

Ordinary Interest vs. Exact Interest

| Aspect | Ordinary Interest | Exact Interest |

| Year Basis | 360 days | 365 or 366 days (leap year) |

| Ease of Calculation | Simplified | Slightly more complex |

| Accuracy | Less accurate for long durations | More precise |

| Common Usage | Banking and short-term loans | Legal documents and formal agreements |

Applications of Ordinary Interest

- Banking

Used for short-term loans, promissory notes, and savings accounts to simplify interest calculations.

- Investment Agreements

Ordinary-interest can be applied in bond agreements or investment products with fixed durations.

- Commercial Transactions

Businesses may use ordinary-interest in trade credit arrangements or invoice settlements.

Advantages and Limitations

Advantages

- Simplifies Calculations: Reduces computational complexity.

- Standardized Approach: Universally recognized in banking and finance.

Limitations

- Less Accurate: Slightly underestimates or overestimates interest for long durations.

- Not Suitable for Precise Agreements: Legal or complex financial contracts often require exact interest.

Conclusion

Ordinary interest offers a simplified and standardized way to calculate interest, especially for short-term financial transactions. While it may not provide the same precision as exact interest, its ease of use makes it a popular choice in banking and commercial applications.

Understanding how ordinary-interest works and when to use it can help you manage loans, investments, and business agreements more effectively.

FAQs

1.What is ordinary interest?

Ordinary-interest is interest calculated based on a 360-day year, commonly used in banking and finance for simplicity.

2.How is ordinary-interest calculated?

The formula is: Principal×Rate×Time (in days)360\text{Principal} \times \text{Rate} \times \frac{\text{Time (in days)}}{360}.

3.What is the difference between ordinary and exact interest?

Ordinary-interest uses a 360-day year, while exact interest is based on the actual 365 or 366 days in a calendar year.

4.When is ordinary-interest used?

It’s often used in banking, short-term loans, and commercial transactions where simplicity is preferred.

5.Why does ordinary-interest use a 360-day year?

The 360-day year simplifies calculations, especially when dividing into months or quarters.

Also read: How to Use Disclaimer Images Effectively: Tips and Examples