If you’re paid every two weeks, you might have wondered: “How many biweekly pay periods in a year?” This is more than just a curiosity—it affects budgeting, payroll, tax planning, and even employee benefits.

In this guide, we’ll break down the math behind biweekly payroll, explain how it works in regular vs leap years, and how it may lead to an “extra” paycheck some years.

What Is a Biweekly Pay Period?

A biweekly pay period is a payroll schedule where employees are paid once every two weeks, typically on the same day of the week (e.g., every other Friday). Over time, this leads to 26 pay periods in a regular year.

So, How Many Biweekly Pay Periods Are in a Year?

There are 26 biweekly pay periods in a standard 52-week calendar year.

Here’s the breakdown:

- 52 weeks ÷ 2 weeks = 26 biweekly paychecks

Each year typically contains exactly 52 weeks (365 days), meaning you receive 26 paychecks if you’re paid biweekly.

What About Leap Years?

A leap year has 366 days, which is 52 weeks plus 2 extra days. So, every few years, there’s the potential for a 27th biweekly pay period depending on the day your payroll cycle starts.

- In most cases, employees still receive 26 paychecks

- However, some years can include 27 pay periods, especially for salaried workers

How a 27th Pay Period Affects Payroll

If you’re paid biweekly, every 11 years or so, a 27th pay period can occur. This might sound great, but it has some payroll implications for both employees and employers.

For Employees:

- You may get an “extra” paycheck that year

- Each paycheck might be slightly smaller if you’re salaried (because annual pay is split over 27 instead of 26 checks)

- Budgeting tip: Use the extra paycheck to build savings or pay off debt

For Employers:

- Budgeting becomes critical for payroll planning

- Benefits like 401(k) contributions or health insurance deductions may need adjustments

Biweekly vs. Other Pay Schedules

| Pay Schedule | Pay Periods per Year | Paychecks per Year |

| Weekly | 52 | 52 |

| Biweekly | 26 (sometimes 27) | 26 or 27 |

| Semi-monthly | 24 | 24 |

| Monthly | 12 | 12 |

Biweekly pay is popular because it strikes a balance between employee cash flow and employer cost-efficiency.

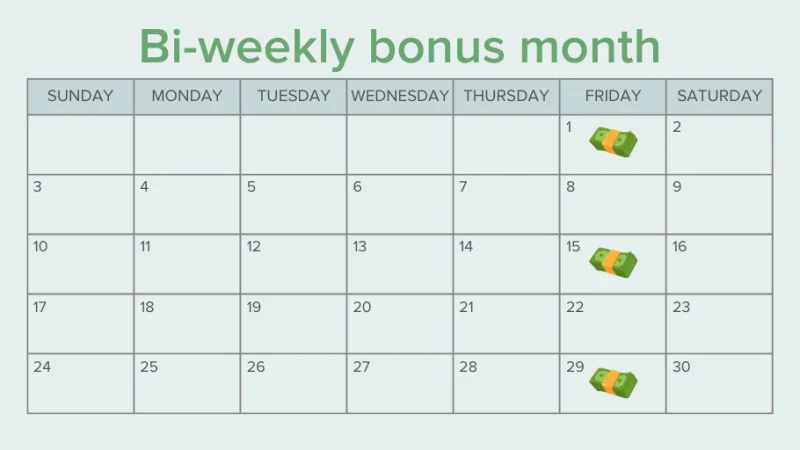

What Months Have 3 Paychecks in Biweekly Years?

In years with 27 pay periods, two months will include three paychecks instead of the usual two. This usually depends on the day of the week your payroll lands on.

Example:

- If payday is Friday and the year starts on January 1 (a Friday), paychecks fall on Jan 1, Jan 15, and Jan 29. Boom—three checks in one month!

How to Plan for a 27-Paycheck Year

- Check your payroll calendar annually

- Identify if a 27th paycheck will occur

- Adjust benefit withholdings (e.g., divide premiums by 27 instead of 26)

- Communicate changes with HR or accounting

- Consider using the 27th check for savings or taxes

How Employers Handle 27 Biweekly Pay Periods

Employers typically have two options:

Option 1: Adjust the Pay

Spread the annual salary over 27 pay periods. This results in slightly lower checks each pay period.

Option 2: Keep the Pay Fixed

Pay the same amount 26 times and add the 27th paycheck as a bonus. This can increase employer payroll liability and tax calculations.

Benefits Deductions in 27-Paycheck Years

Benefits like health insurance or retirement contributions are usually based on 26 pay periods. So what happens when there are 27?

- Employers may skip deductions on the 27th paycheck

- Or divide annual costs across 27 checks, making each deduction slightly smaller

It’s important to review benefit plans with your HR team in these cases.

Conclusion

To sum it up:

There are 26 biweekly pay periods in a regular year, and occasionally 27 in leap years or depending on your payroll calendar.

This small quirk of the calendar can impact payroll, budgeting, benefit deductions, and employee satisfaction.

Whether you’re an employee or employer, understanding your payroll schedule can help you plan smarter and make better financial decisions.

FAQs

1. How many biweekly pay periods are in 2025?

In 2025, there will be 26 biweekly pay periods for most companies unless your payroll schedule begins on a specific day that causes a 27th check.

2. What’s the difference between biweekly and semi-monthly?

Biweekly means every 2 weeks (26 paychecks); semi-monthly means twice per month (24 paychecks).

3. Do salaried employees get an extra paycheck in a 27-paycheck year?

Yes, but the annual salary is usually divided by 27 instead of 26, so each check may be smaller.

4. Can I request my employer to skip deductions on the 27th paycheck?

It depends on company policy, but some do waive benefit deductions on the 27th check.

5. How do I find out if my payroll year includes 27 pay periods?

Ask your HR department or payroll provider for a copy of the biweekly payroll calendar.

Also read: Why You Should not Use LegalZoom: The Hidden Risks of DIY Legal Services