Navigating the council tax Cherwell system can be daunting, especially in regions where local policies and regulations may add layers of complexity. However, with the right approach and knowledge, you can manage your council tax Cherwell efficiently and even discover opportunities for savings. This guide will walk you through ten essential steps to navigate the council tax Cherwell system like a pro, ensuring you understand your obligations, rights, and potential benefits.

Understand What Council Tax Cherwell Is

Council tax Cherwell is a local tax levied on residential properties by local authorities in England, Scotland, and Wales. The revenue from this tax funds essential public services such as education, waste management, and local infrastructure maintenance. In Cherwell, as in other areas, the amount you pay depends on the value of your property, which is assessed and placed in one of eight valuation bands.

Check Your Council Tax Cherwell Band

The first step in managing your council tax Cherwell effectively is to know your property’s tax band. Properties in Cherwell are categorised from Band A to B And H, with Band A being the lowest and Band H the highest. You can find out your property’s council tax Cherwell band by visiting the Valuation Office Agency (VOA) website. If you believe your property has been incorrectly banded, you have the right to challenge this assessment.

Know the Council Tax Cherwell Calculation Method

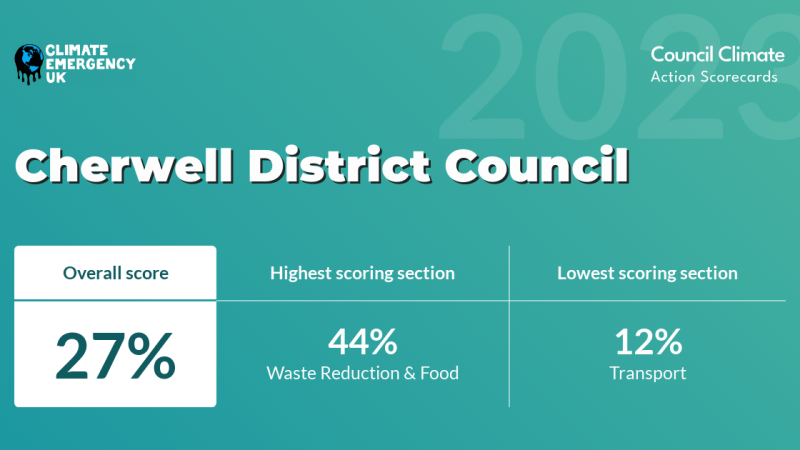

Understanding how your council tax Cherwell is calculated can help you anticipate your annual bill and budget accordingly. In Cherwell, the council tax is calculated by multiplying the property’s tax band by the rate set by the Cherwell District Council, which includes contributions to local policing and fire services. The council tax rate is reviewed annually, so it’s important to stay updated on any changes.

Explore Council Tax Cherwell Discounts and Exemptions

There are several discounts and exemptions available that can significantly reduce your council tax Cherwell bill. In Cherwell, some common discounts include the single person discount, which offers a 25% reduction if you live alone, and the student exemption, which applies if all residents are full-time students. Additionally, certain properties like those occupied by severely mentally impaired individuals or those that are unoccupied and undergoing structural repairs may also qualify for exemptions.

Apply for Council Tax Support

If you are on a low income or receiving certain benefits, you may be eligible for council tax support. This scheme can reduce your council tax bill by a significant amount, depending on your financial circumstances. In Cherwell, you can apply for council tax support online through the Cherwell District Council’s website. Make sure to provide all necessary documentation to facilitate a smooth application process.

Understand Your Payment Options

Cherwell District Council offers several payment options to make it easier for residents to manage their council tax bills. You can choose to pay annually, biannually, or in monthly instalments. Setting up a Direct Debit is often the most convenient method, ensuring your payments are made on time without the need for manual intervention. Additionally, you can pay online, by phone, or in person at designated payment centres.

Stay Informed About Changes

Local council tax rates and regulations can change annually based on budget requirements and policy decisions. Staying informed about these changes can help you avoid surprises on your bill. Cherwell District Council typically announces rate changes in advance, giving residents time to adjust their budgets accordingly. Subscribe to council newsletters or regularly check the council’s website for updates.

Challenge Your Council Tax Band

If you believe your property is in the wrong council tax band, you can challenge the assessment. In Cherwell, this involves contacting the Valuation Office Agency with evidence that supports your claim. This might include information about similar properties in your area that are in a lower band. If the VOA agrees with your assessment, your property will be rebanded, potentially lowering your council tax bill.

Manage Arrears Effectively

Falling behind on council tax payments can lead to serious consequences, including legal action and additional charges. If you find yourself in arrears, it’s crucial to act quickly. Contact Cherwell District Council to discuss your situation and explore options for a repayment plan. They may offer flexibility in repayment terms to help you get back on track without incurring further penalties.

Seek Professional Advice

Navigating the complexities of council tax can be challenging, especially if you have unique circumstances. Seeking professional advice from a financial advisor or a local government expert can provide personalised guidance and ensure you are maximising your entitlements while fulfilling your obligations. In Cherwell, local advice services and citizen’s advice bureaus can also offer support and information.

Conclusion

Managing your council tax Cherwell doesn’t have to be overwhelming. By following these ten steps, you can navigate the system like a pro, ensuring you are well-informed and prepared to handle your council tax Cherwell efficiently. From understanding your tax band to exploring discounts and seeking professional advice, each step is designed to help you make the most of the resources and support available. Stay proactive, stay informed, and take control of your council tax Cherwell today.

FAQs

1. What is the purpose of council tax Cherwell?

Council tax Cherwell, as in other areas, funds local services such as education, waste collection, public safety, and infrastructure maintenance. The revenue supports the community by providing essential services that residents rely on daily.

2. How can I find out my council tax band in Cherwell?

You can find out your council tax band by visiting the Valuation Office Agency (VOA) website and entering your property details. The band is based on the property’s estimated value as of April 1, 1991, for England.

3. What should I do if I think my council tax band is incorrect?

If you believe your council tax band is incorrect, you can challenge it by contacting the Valuation Office Agency with evidence supporting your claim. This might include information about similar properties in your area that are in a lower band.

4. Are there any discounts available for council tax in Cherwell?

Yes, there are several discounts available, including the single person discount (25% off if you live alone), student exemptions, and discounts for properties occupied by severely mentally impaired individuals. Check the Cherwell District Council website for a full list of available discounts.

5. How can I apply for council tax support in Cherwell?

You can apply for council tax support if you are on a low income or receiving certain benefits. Applications can be made online through the Cherwell District Council’s website. Ensure you have all required documentation ready to support your application.

Also read: QUEENS GATE MEWS REVEALED: 10 REASONS WHY IT’S LONDON’S HIDDEN GEM, THE BEST-KEPT SECRET