In the digital age, managing data accurately is crucial for businesses. One critical method for ensuring data integrity is the use of control totals. These totals act as a verification tool to ensure that data entered, processed, or transferred matches the original source. Widely used in accounting, payroll, inventory systems, and IT processes, control totals minimize errors, detect fraud, and maintain operational accuracy.

This article explains what control totals are, their types, and how they play a significant role in maintaining data and financial accuracy.

What are Control Totals?

A control total is a sum or value calculated from a set of data, used as a benchmark to verify the accuracy of data entry, processing, or transmission. When data is transferred between systems or manipulated, control totals ensure consistency by comparing the initial and processed totals.

For example:

- In payroll, the total gross salary amount before and after processing can act as a control total.

- In data systems, the total number of records processed serves as a check for completeness.

Types of Control Totals

- Financial Control Totals

These totals are used to verify monetary values in transactions. For instance, summing all the invoice amounts during data entry and comparing them with the system’s final total ensures all entries are captured accurately.

- Record Count Totals

This type checks the number of data records before and after processing. If the record count differs, it indicates missing, duplicated, or extra entries that need investigation.

- Hash Totals

Hash totals are non-monetary control totals, calculated from numeric values like account numbers. They act as a unique identifier to ensure the integrity of data fields during transfer.

- Batch Totals

Used in batch processing systems, these totals sum up all data values in a batch to validate its accuracy during processing or migration.

- Non-Financial Totals

Control totals aren’t always monetary. They can involve inventory counts, customer IDs, or any numerical data used to verify the completeness of processing.

The Importance of Control Totals

- Ensures Data Accuracy

Control totals validate that data has been accurately entered, processed, or transmitted without errors or omissions.

- Enhances Fraud Detection

By identifying discrepancies in totals, businesses can quickly spot fraudulent activities or unauthorized changes.

- Improves Financial Compliance

For businesses, financial control totals ensure compliance with accounting standards and regulatory requirements by verifying that data matches financial statements.

- Streamlines Audits

Control totals simplify the auditing process by providing clear benchmarks for verifying the integrity of financial and operational data.

How Control Totals Are Used in Business

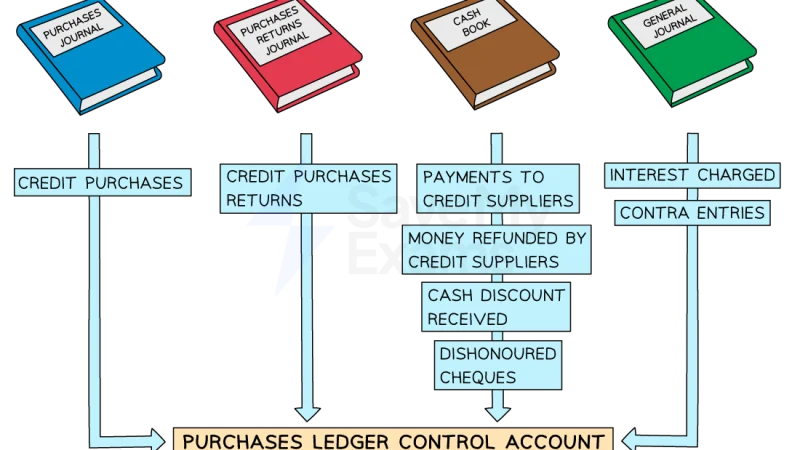

- Accounting Systems

Control totals ensure all debits and credits are correctly recorded and balanced in the ledger.

- Payroll Processing

In payroll, control totals ensure that gross salaries, deductions, and net pay calculations match expected figures.

- IT and Data Processing

Control totals validate data transfers between systems, ensuring all records are accurately migrated without loss or duplication.

- Inventory Management

In inventory systems, control totals verify that item counts match records before and after stock updates or transfers.

Challenges of Using Control Totals

While control totals are a powerful tool, they come with certain challenges:

- Human Error: Manual calculation or data entry errors can lead to incorrect totals.

- Complex Systems: In large-scale operations, managing control totals for complex datasets can be resource-intensive.

- Over-reliance: Relying solely on control totals without complementary checks may lead to undetected issues.

Best Practices for Implementing Control Totals

- Automate Calculations

Use software tools to calculate and verify control totals, minimizing manual errors. - Establish Clear Procedures

Document controls total processes for consistency across teams and systems. - Perform Regular Audits

Periodically review and reconcile control totals to ensure ongoing accuracy and compliance. - Integrate with Existing Systems

Use control totals as part of broader data validation strategies, including error reports and exception tracking.

Conclusion

Control totals are an essential part of any business process that relies on accurate data management and financial transactions. By providing a clear benchmark to verify data integrity, they minimize errors, enhance compliance, and streamline audits. Whether used in accounting, payroll, or IT systems, control totals ensure businesses can operate efficiently while maintaining trust and transparency.

Adopting control totals as part of your data and financial management strategy not only prevents costly mistakes but also builds confidence in your organization’s processes and systems.

FAQs

1.What is a control total in accounting?

A control total in accounting is a sum of monetary values, like invoice totals, used to verify the accuracy of financial data entry or processing.

2.What’s the difference between a hash total and a financial control total?

A hash total is non-monetary and used to verify numerical data, while a financial control total focuses on monetary amounts.

3.How do control totals help in payroll?

In payroll, control totals validate that gross pay, deductions, and net pay match expected amounts, ensuring accuracy and compliance.

4.Can control totals detect fraud?

Yes, discrepancies in control totals can indicate fraud, unauthorized changes, or errors that require investigation.

5.Are control totals only used in financial processes?

No, control totals are also used in IT, inventory management, and data processing to validate the accuracy and integrity of records.

Also read: Record of Shareholders: Importance, Benefits, and Legal Requirements